nebraska sales tax percentage

536 rows Nebraska Sales Tax55. LB 873 reduces the corporate tax rate imposed on Nebraska taxable income in excess of 100000 for taxable years beginning on or after January 1 2024.

Nebraska Tax Rates Rankings Nebraska State Taxes Tax Foundation

The applicate tax rate for.

. The base state sales tax rate in Nebraska is 55. Find your Nebraska combined state. The Nebraska state sales and use tax rate is 55 055.

What is the sales tax rate in Omaha Nebraska. Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information. NE Sales Tax Calculator.

Nebraska has a 55 statewide sales tax rate but also has 337 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0832. Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up. The Nebraska sales tax rate is currently 55.

Counties and cities can charge an. Nebraska has recent rate changes Thu Jul 01 2021. With local taxes the total sales tax rate is between 5500 and 8000.

Nebraska collects a 55 state sales tax rate on the purchase of all vehicles. The state sales tax rate in Nebraska is 5500. Local tax rates in Nebraska range from 0 to 2 making the sales tax range in Nebraska 55 to 75.

If the seller is. In addition to taxes car. On the other hand while Norfolk.

Nebraska Sales Tax Rate Finder. The Nebraska state sales and use tax rate is 55. The minimum combined 2022 sales tax rate for Omaha Nebraska is.

The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. Printable PDF Nebraska Sales Tax Datasheet. Average Sales Tax With Local.

49 rows 75 Sales and Use Tax Rate Cards. ArcGIS Web Application - Nebraska. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska.

The Wahoo Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Wahoo local sales taxesThe local sales tax consists of a 150 city sales tax. Nebraska Application for Direct Payment Authorization 122020 20DP. Groceries are exempt from the Nebraska sales tax.

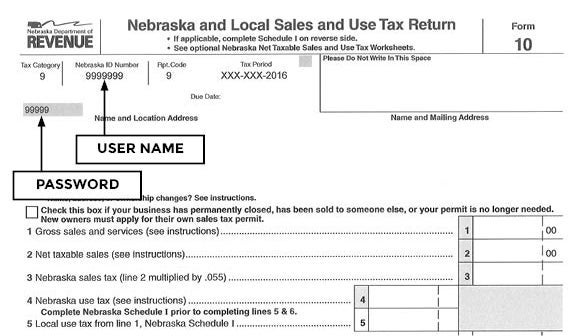

In addition local sales and use taxes can be set at 05 1 15 175 or 2 as adopted by city or county governments. When calculating Nebraskas sales and use tax determine the taxes the local jurisdiction charges for the city and county then add those percentages to the state sales tax percentage of 55. This is the total of state county and city sales tax rates.

This is the total of state county and city sales tax rates. Nebraska has a statewide sales tax rate of 55 which has been in place since 1967. For vehicles that are being rented or leased see see taxation of leases and rentals.

The minimum combined 2022 sales tax rate for Wisner Nebraska is 75. The state sales tax rate in Nebraska is 55 but you can customize this table as needed to reflect your applicable local sales tax rate. 1 day agoA proposed half-percent sales tax would get the city caught up with many of those needs and wants with safety streets sports and recreation.

Nebraska Sales Tax Rate Changes April 2019

Nebraska Sales Tax Rate Table Woosalestax Com

Oregon S Business Taxes Tied For Lowest In The Nation Oregon Center For Public Policy

Sales Taxes In The United States Wikipedia

General Fund Receipts Nebraska Department Of Revenue

/cloudfront-us-east-1.images.arcpublishing.com/gray/MVMWZY7JTZC5HK6TDJ44RACC34.JPG)

Kansas Food Sales Tax Is 2nd Highest In U S Governor Potential Opponent Support Exemption

Nebraska Income Tax Ne State Tax Calculator Community Tax

Online Sales And Use Tax Filing Faqs Nebraska Department Of Revenue

Wfr Nebraska State Fixes 2022 Resourcing Edge

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

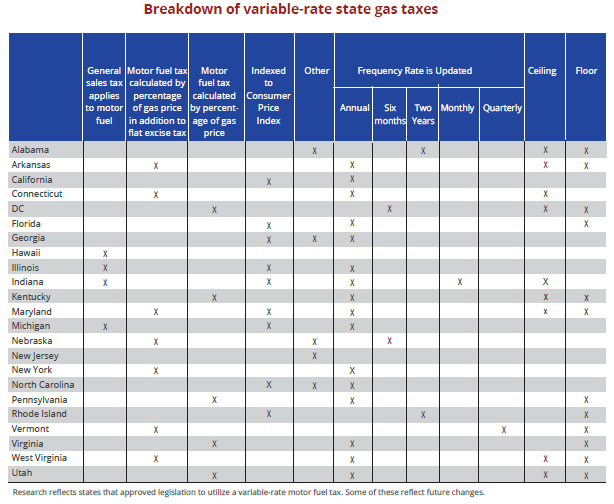

Variable Rate State Motor Fuel Taxes Transportation Investment Advocacy Center

10 Pros And Cons Of Living In Nebraska Right Now Dividends Diversify

Policy Brief Typical Family Pays Less Tax In Nebraska Than In Most Similar States Open Sky Policy Institute

Nebraska Income Tax Calculator Smartasset

State And Local Sales Tax Rates Midyear 2014 Tax Foundation